CA BE-IRC Order Form 2010-2025 free printable template

Show details

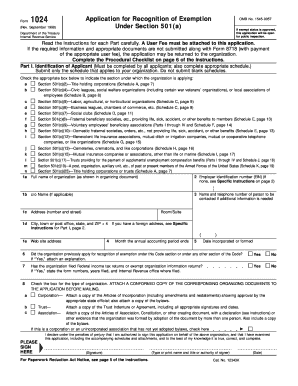

Please complete both REFUND AMOUNT BALANCE DUE THIS SPACE FOR OFFICE USE ONLY BE - IRC ORDER FORM REV 08/2010 Page 1 of 2 Entity Type Select the applicable entity type. Secretary of State Business Programs Division th Certification and Records 916 657-5448 1500 11 Street 3rd Floor P. O. Box 944260 Sacramento CA 94244-2600 Business Entities Records Order Form To obtain information relating to a business entity of record with the California Secretary of State complete both pages of this order...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign irc application form

Edit your irc form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california business records form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing california irc online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit california records form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ca entities form

How to fill out CA BE-IRC Order Form

01

Obtain the CA BE-IRC Order Form from the official website or office.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information accurately, including name, address, and contact details.

04

Specify the items or services you are ordering in the designated section.

05

Indicate the quantity and any specific preferences you may have.

06

Provide any additional information or comments in the provided area.

07

Review the completed form for any errors or omissions.

08

Sign and date the form at the bottom.

09

Submit the form according to the provided submission guidelines.

Who needs CA BE-IRC Order Form?

01

Individuals or businesses wishing to place an order with CA BE-IRC.

02

Clients requiring specific items or services from CA BE-IRC.

03

Anyone needing to formalize their order request with CA BE-IRC.

Fill

california entities

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send entities form for eSignature?

irc application is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute california records order online?

Filling out and eSigning records order is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit irc online application on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share irc forms download pdf from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is CA BE-IRC Order Form?

The CA BE-IRC Order Form is a document used in California to request an order for the payment of business expenses incurred by the state. It is specifically related to the California Business Expense Reimbursement and Incentive Reporting Certificate.

Who is required to file CA BE-IRC Order Form?

Entities that have received business expense reimbursements or incentives from the state of California are required to file the CA BE-IRC Order Form.

How to fill out CA BE-IRC Order Form?

To fill out the CA BE-IRC Order Form, provide the required business information, detail the expenses for reimbursement, include any necessary documentation, and ensure all sections of the form are completed accurately before submission.

What is the purpose of CA BE-IRC Order Form?

The purpose of the CA BE-IRC Order Form is to facilitate the reimbursement process for businesses that have incurred eligible expenses, ensuring proper reporting and accountability for state funds used.

What information must be reported on CA BE-IRC Order Form?

The CA BE-IRC Order Form must report the business's identification details, the nature and amount of the expenses incurred, documentation supporting the expenses, and any relevant financial information pertaining to the reimbursement request.

Fill out your CA BE-IRC Order Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irc Forms is not the form you're looking for?Search for another form here.

Keywords relevant to copy clear form pdf

Related to irc order entity blank

If you believe that this page should be taken down, please follow our DMCA take down process

here

.